Real Estate Investors!

From buy-and-hold portfolios to quick flips or new rental developments, we deliver capital that moves at the speed of your strategy.

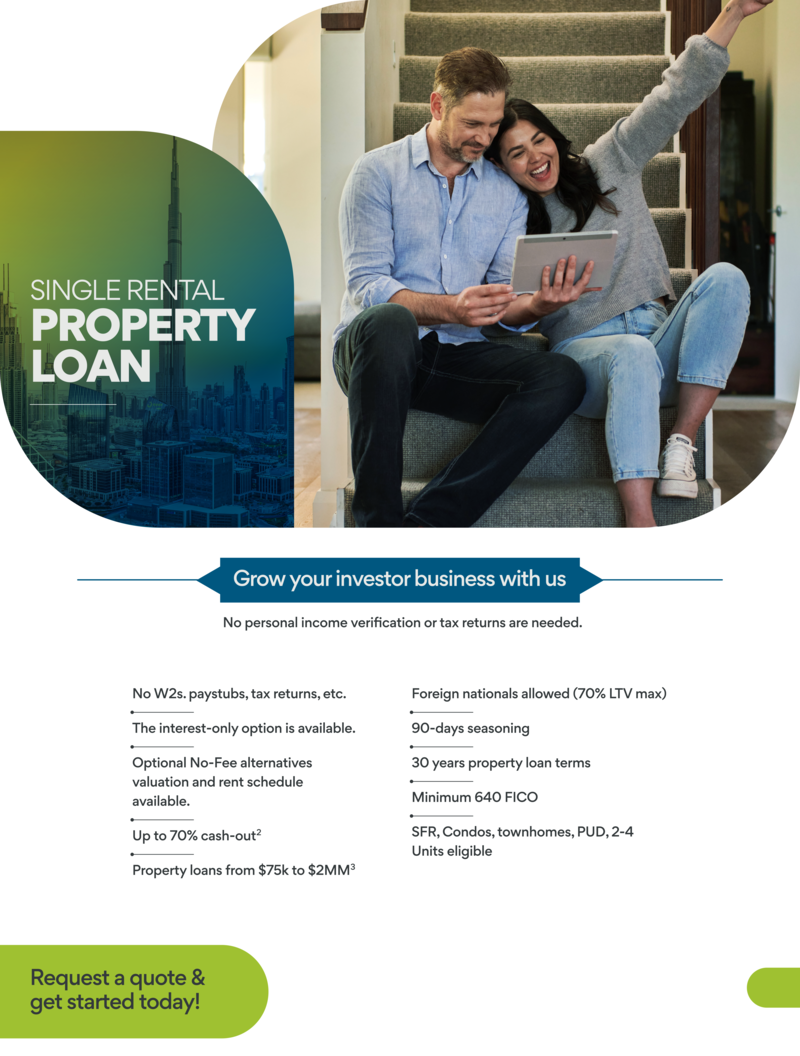

Count on stable rental loans for your income-producing properties and flexible short-term financing for growth opportunities.

We're here to help you grow faster and smarter—with affordable, reliable funding to help you boost ROI!

Count on stable rental loans for your income-producing properties and flexible short-term financing for growth opportunities.

We're here to help you grow faster and smarter—with affordable, reliable funding to help you boost ROI!